Who can apply

The Drought Ready and Resilient Fund loan is available to eligible sole traders, partnerships, trusts or private companies who operate in the primary production sector in NSW.

To be eligible, applicants must earn at least 50% of gross income or at least $75,000 in one year from the primary production business, or be a bona fide primary production enterprise.

Please refer to the program guidelines for further details.

Assistance available

Drought Ready and Resilient Fund loans can be used to purchase a broad range of products, activities and services, including:

- the purchase and transportation of fodder and water

- livestock feeding equipment

- veterinary and animal welfare professional services

- genetic banking

- fencing and containment pens

- shade structures

- planting of trees

- farm income diversification projects

- pest and weed control

- solar power conversion

- soil conservation and earthworks

- training and development

- infrastructure repairs and maintenance

- the purchase and installation of new on-farm infrastructure.

Please refer to the program guidelines for further details.

Loan terms

Maximum amount:

Drought Ready and Resilient Fund loans are up to a maximum of $250,000.

Interest rate:

The current interest rate for Drought Ready and Resilient Fund loans is:

- 4.5% per annum for a 5-year loan

- 5.2% per annum for a 10-year loan

Customers will be provided with an indicative interest rate at the point of application, however the rate applied to the loan will not be determined until the date of first drawn down.

The interest rate applied to the loan is fixed for the term of the loan.

Repayments:

Loans can be repaid monthly, quarterly, bi-annually or annually over a term of five or ten years.

Please refer to the program guidelines for further details.

What you will need to apply

When you lodge an application for a loan, you will need copies of the following documents:

- the last 3 years of the applying primary production enterprise’s tax returns, balance sheets and financial statements (including profit and loss statements, stock trading account and depreciation schedules)

- the last 3 years of individual tax returns of all members of the primary production enterprise and a current listing of all assets and liabilities held by each individual director, shareholder, partner or trustee of the primary production enterprise (Note: Tax Assessment Notices are not acceptable)

- the last 3 years of tax returns and financial statements for all related business entities that individual members of the primary production enterprise are involved in, if applicable

- Local Government Area (LGA) rates notice and, if available, the Local Land Service (LLS) rates notice for the property where the work is to be completed

- signed Consent to Contact Lenders Form (if required) (download a Consent to Contact Lenders Form)

- Farm Business Resilience Plan (or equivalent) (download a Farm Business Plan Template)

- trust deed (if applicable)

- monthly cash flow budget for the next 12 months (download a Cash Flow Statement Template)

- confirmation of bank details, such as the front page of a bank statement showing the account name, BSB, and account number.

Please refer to the program guidelines for further details.

Apply now

Before commencing your application, please ensure you have thoroughly read and understood the program guidelines. The version of the program guidelines published on the date you submit your application apply.

Please ensure you download and save, or print, a copy of the program guidelines for future reference.

The online application form has been designed to make the process as simple as possible. We recommend you have all scanned documents ready to upload before starting the process. We also recommend that you use the Google Chrome browser when applying.

Please note that the online form has file size restrictions (approx. 20MB total) – for each attachment please ensure the file size is 2.5MB or less to avoid submission issues.

If you are unsure at any stage of the process as to how to complete the online application form, please use the Drought Ready and Resilient Fund example application document for information and helpful tips on how to proceed:

Drought Ready and Resilient Fund - Example Application

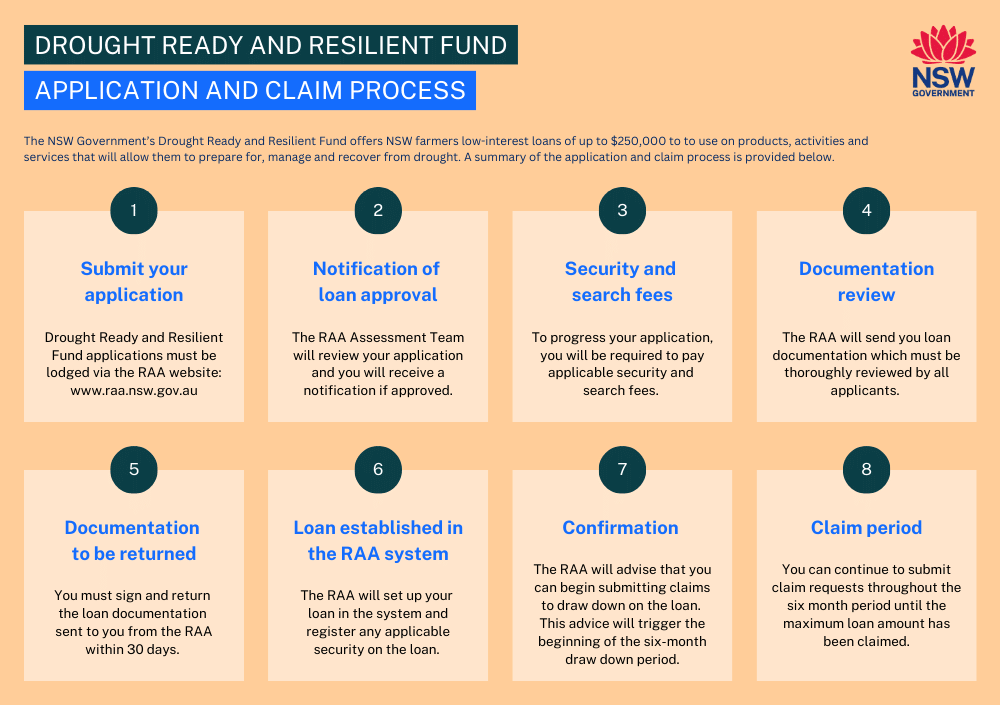

Below is a summary of the RAA's application and claim process for the Drought Ready and Resilient Fund:

Claim payment

Once your application has been approved, you will be advised of the process to submit invoices to claim payment.

Please note that the online form has file size restrictions (approx. 20MB total) – for each attachment please ensure the file size is 2.5MB or less to avoid submission issues.

To lodge a claim, you will need:

- BP reference number

- ABN number

- Case number from original application

- Tax invoices

Please note, invoices to be claimed under this program must be submitted within six months of application approval.

You can claim for the GST-exclusive amount of eligible invoices.

We recommend you use the Google Chrome browser when submitting a claim. If you are unsure at any stage of the process as to how to complete the online claim form, please refer to the Example Claim Request Form.

Below is a summary of the RAA's application and claim process for the Drought Ready and Resilient Fund:

Frequently asked questions

Additional information about the Drought Ready and Resilient Fund can be found on our Frequently Asked Questions webpage:

DroughtHub

Visit NSW DroughtHub for more information on the full range of drought assistance available to NSW farmers.

Need help?

If you have any questions about this program you can contact our team by calling 1800 678 593 or emailing rural.assist@raa.nsw.gov.au.

If you have difficulty understanding the guidelines or completing the application form you should seek the assistance of your rural/financial counsellor, business advisor, accountant or a trusted family member/friend. If you need assistance with interpreting or translating, please contact Multicultural NSW on 1300 651 500 or email languageservices@multicultural.nsw.gov.au.

If you are experiencing any issues completing the form, free confidential assistance is available from your local Rural Financial Counselling Service (RFCS). For more information, visit the relevant website or call:

Northern region: 1800 344 090

Southern and Central region: 1800 319 458